2 Problem areas blacklisted individuals must fix to qualify for vehicle finance.

Driving the vehicle of your dreams is every driver license holder’s desire. But to be a vehicle owner, one needs to have the financial means to make that dream a reality.

This article is dedicated to blacklisted individuals that have a burning desire to buy a vehicle on finance again.

As a blacklisted individual there are 2 main issues that are preventing you from an approval…

1. Your credit record

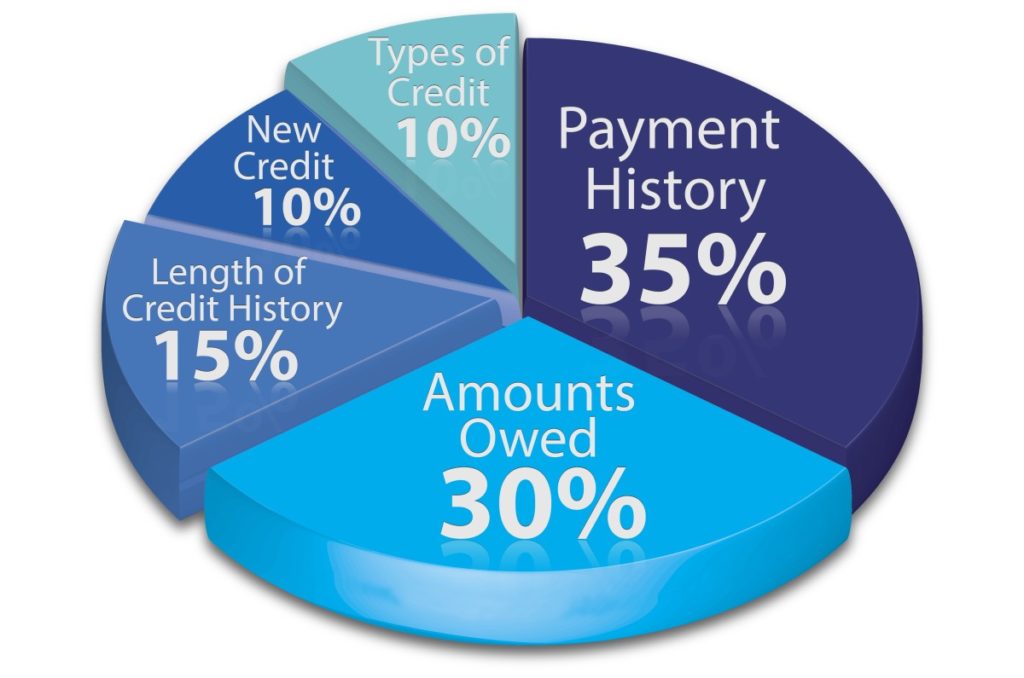

To qualify for vehicle finance, your credit score needs to be above 600. Your credit score is a number that is compiled by 5 aspects of your credit health. 35% of your score is based on your payment history and 30% counts for the total amount you owe on your report. These two hold the greatest weight so they are the two important factors you must focus on if you want to improve your score.

If you are currently “blacklisted” it means that you have already defaulted on your credit payments. Late payments, missing payments or paying less than is due will negatively impact your credit record and lower your credit score.

2. Affordability

30% of your credit score accounts for the total amount of debt you owe compared to the income you earn. According to the NCR regulations only one third of your income should be allocated monthly to debt. So, if your total debt repayments monthly are more than one third you are considered over-indebted. You would therefore need to make room in your current finances to afford the vehicle installment.

Your payment history and affordability also have a large impact on your credit record. If you are currently blacklisted, it is a sign that you need to work on these areas if you want to progress in life. There is no benefit to remaining in debt because it holds you back. It is already preventing you from having the keys in your hands for the vehicle of your dreams.

There is a way that you can fix both these areas with the help of a financial “guru”.

You need a debt expert that can apply sound financial principles to your finances to help you find your balance.

Through our debt management program, you will be able to tackle the problem head on but let someone else do the dirty work for you. All you do is pay our debt management expert a reduced monthly installment every month. He will negotiate with your creditors to reduce your monthly payments in line with your income.

The goal is to make sure your living expenses are covered following which your creditors get the balance. This is an important step in your recovery because it brings your finances back into balance. You will no longer rely on credit to pay for what is short every month. We want to help you cover your expenses with your income like it is meant to be.

While you are under the program our debt experts use your monthly payment to pay off your debt. They look for prescribed debt opportunities and massive discounts offered to help you reduce the balance. All of this goes on in the background while you focus on your career, family and social life.

Once the accounts are cleared, they will be closed and removed from your credit record. When your record is clear, your score over 600 and you have disposable income to cover the vehicle installments, you can proceed to apply for finance.

It is important to note that the debt management program has no court order on your name nor a set period. You can use the program as a tool to manage your finances while you need it. As soon as you feel comfortable that you can do it on your own, you can withdraw from the program.

Let us recap! Your credit score and affordability are the two main issues affecting your approval for vehicle finance. We have shared this information based on our experience working with credit applications. For finance to be approved, affordability and a good credit record is necessary. There are no short cuts, luck or another loan that can fix the problem. Only a plan to deal with the problem can help you fix your credit record.

The sooner you start, the sooner you will be driving your new vehicle away from the dealership. It is that simple 🙂

Thank you for sharing your time with us. We are here for you and ready to connect you with our debt management expert. All you need to do is reach out and ask for your help.

Visit the debt management page or email me at judy@premierdebt.co.za if you have any questions.