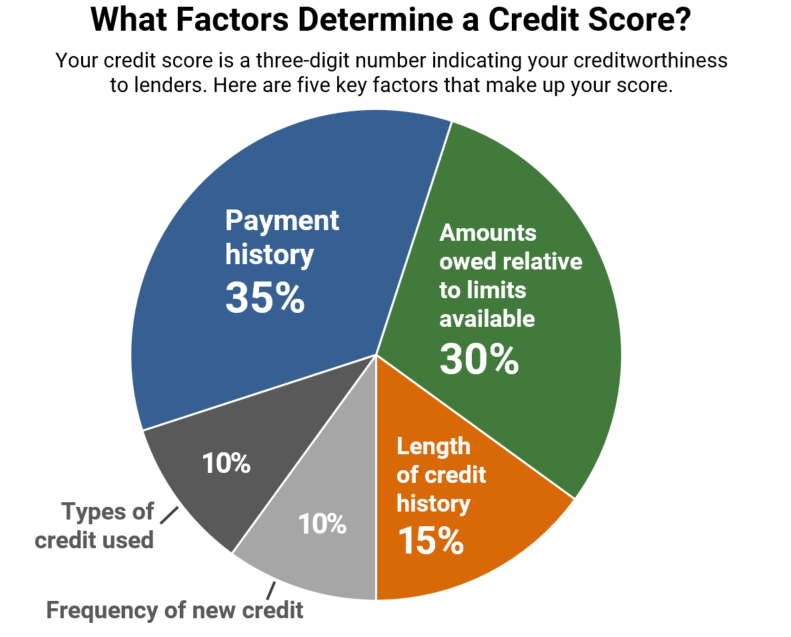

What makes up 30% of your credit score?

Your credit score is a 3-digit number that represents your credit worthiness to lenders.

It’s the score lenders use to determine if you are a person that they want to do business with. When your score is lower than 630, they do not consider your application. The minute you type in your id number your score reflects and the system declines you. That is why the only way to get accessed for an application is to improve your credit score to at least 630.

The second largest percentage that makes up your score is based on how much you have used of your credit limits. The credit bureaus use this to determine your reliance on your credit lines. Are you a person that uses credit wisely and only when necessary? Or are you a person that swipes on credit whenever you can?

When you use more than 50% of your credit limits it drops your score. And because this is the second highest percentage it has a great impact on your overall total score.

Credit should be used as leverage to help us improve our lives. For example, buying a house or vehicle, starting a business, or going to study. Those are all good reasons for credit. It helps you to change your current position and empower yourself to be able to achieve your goals.

Credit bureaus monitor your unsecured debt spend. This is personal loans, short term loans, credit cards and store cards. Unsecured debt that gets used to buy consumable products is not a good way to use credit. You are paying interest for that product so you are paying more for the item than what it would cost you cash. This steals your buying power and forces you to have to pay more for everything that you swipe for.

For example: If a pair of shoes costs you R1000 by the time you have settled the bill on credit, you could have paid R1800. That means you are paying nearly double what you would have paid cash. Instead of buying only one pair, if you had saved the R1800 and paid cash you could have bought two pairs.

Cash is King

The best way to reduce your spend on credit is to realise that cash is king. By adopting this principal in your life, you can learn to work differently with your money.

Instead of paying all your money monthly to lenders and then swiping on the cards to make it, try a different approach. Cut your lines of credit and focus on saving. Imagine if you don’t have to pay R5000 per month to credit cards and store cards. You can rather save that money and build cash reserves. Then when you want to buy shoes for R1000, you take it out of your savings and pay what the shoes are worth and nothing more. The extra R800 that you would have paid to creditors now sits in your savings account earning you interest. By living off cash you can earn money on your savings and can look at investing and make even more money. You are no longer making lenders rich but instead empowering yourself to have more money. This is a win in my eyes.

The best way to get off the credit train

When I was in debt the only thing that helped me to stop relying on credit was to cancel all my lines of credit. I went under a debt restructuring program called debt counselling to help me achieve this. I realised that I needed to change my ways and the only way to do it was to put myself in a position that ends my credit usage.

The debt counselling process helped me reduce my monthly payments to creditors. So even though I did not have access to credit, I was able to rework my finances so I could budget with my salary. Instead of swiping I moved to work with cash. Everything I needed for 5 years was paid for in cash. In the beginning it was tough but after a few months I started to adjust to a new way of life. I no longer had access to credit, so I had to find ways to make more money. If I wanted to live a lifestyle that my salary didn’t cover, I had to start a side hustle to cover the shortfall. And when I was able to start saving that is when the magic happened in my life.

Savings helped me build my own financial support, so credit was no longer important. It helped me to pay for whatever I needed, including our wedding. I started to see how by working with cash I was getting more bang for my buck, and it changed my ways for good.

Today even though I am rehabilitated with a good credit score, I still limit my credit usage. I only have one card to maintain a credit score and the rest is paid with cash.

This is why I want to help you because I’ve been where you are and I know the only way out of it is to change your ways. By accepting help with debt counselling, you can sacrifice a short period of your life for a far better future. Sacrifice swiping now for earning interest and generating a passive income. This is all possible if you switch from living on credit to living off cash.

Conclusion

Thirty percent of your credit score is based on how much of your credit limit you have used. A person that follows sound financial management will only use credit sparingly. If you find yourself in a position where you have maxed out your credit and you can’t repay your creditors, you need our help.

Speak to me about getting an assessment for debt counselling. We can help you to restructure your debt so that you can cover all expenses with your income. The surplus you have left over can help you build savings so that you too can enjoy the benefits of living off cash.