Lock down your debt

It’s a remarkable and grim time to be alive. In 8 days, our lives turned upside down and we don’t know which way to turn accept social distancing. This is a new human virus so we don’t have any historical data that can provide us with accurate predictions.

What we do know is the global pandemic is affecting economies and lives across the world. The slowdown in economic activity will affect everyone’s finances. It is going to be more difficult to avoid losses.

Financial literacy and careful budgeting are two tools you can use at your disposal now. It’s imperative to ensure you can get out the other side with minimal financial risk.

From Friday the country will be in a 21-day lockdown with only essential services left open to run. At this stage it’s still early days so there will be more changes in the economy and massive job losses.

We need to keep all these factors in the back of our minds when making financial decisions.

In this blog I will share some positive ways you can control your thoughts and actions. The idea is to lock down your debt now so you will have a better financial outlook for the future.

Don’t panic, rather keep a calm and rational head.

The news headlines about panic buying last week is a clear example of how panic can add more fuel to a burning fire. When our president announced that our country was in a state of disaster, it set off fear across the nation. People reacted to the fear with panic. They chose to make decisions to buy from emotions instead of logical thinking. This resulted in disruption of supply chains across the country. Many food stores are now unable to meet their client’s needs.

We need to learn from this with regards to our financial choices now. We need to work wise with the money we have. That means maintaining a balance between servicing our commitments and food.

It is not advisable to spend all our financial resources on one part of our lives and not be able to keep the balance.

If you are buying on credit, you need to have the financial means to be able to service that debt. The last thing you want to do is spend unnecessarily now when you are not sure what the future holds for your income.

A wise way to proceed is to keep a calm head and think of all the financial repercussions before you spend. Think 3 times before you spend and make sure it’s the right decision before you commit.

Your future self will thank you later 🙂

-Dave Ramsey

Save where you can and budget efficiently

I read a blog last week on businesstech.co.za where they went into detail about extra costs we will spend now. There will be extra cost implications for parents that they did not budget for. These costs include electricity, toilet paper, food and entertainment costs.

As the economy contracts, we will feel the pinch more. It’ advisable to work smart with your limited resources so you can get more value for your money.

We work from home, so we’re used to working and living in the same environment. If you are new to remote work, then you may find it a change in the beginning like we initially did.

Here are some tips we learnt to manage our resources at home.

1. Stick to a routine – you should treat your workdays like ordinary work days at the office. This will help you manage your time better and keep your mind focused.

2. Meal prep and cook meals in bulk. To keep your family’s bodies healthy, you want to eat as much vegetables as you can. We eat lots of legumes which take time to cook but the can options work out too expensive. We learnt to save time, electricity and money by buying in bulk, and cooking them in weekly portions.

We also cook enough food at night so that we have enough for lunch the next day. By doing this we save at least an hour out of our day every day and reduce the dishes that creep up on you.

3. Only eat when you are hungry. This is difficult to do when you get bored with nowhere to go and a pantry full of food at your disposal. So, to break this curve we only eat set meals at set times. It’s important to listen to your body and not eat just to pass time. Rather use the time to find an activity to keep your mind active like yoga, an online course or read a book.

4. Keep lights off in rooms that you are not using. If you can switch to cooking on gas it does work out more cost effective. This will especially be helpful if you are cooking more often at home.

5. Limit online spending. There will be a lot of good specials floating around online now. Businesses will be scrambling for money to keep the boat afloat. It’s best to not get carried away and save your money for essentials.

Maintain your monthly payments

It can be tempting to miss payments for short term gain, but it will not help your financial position. No debt is being excused during this period. If you do make a payment arrangement you are still responsible for that debt. All you are doing is buying yourself time now to deal with immediate cash shortages.

Debt counsellors have made it clear that debt review payments are still valid. The same will count for all credit contractual agreements.

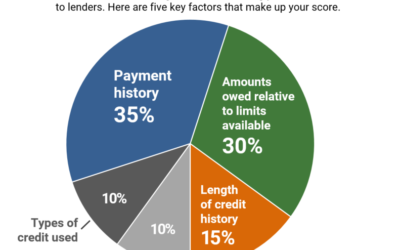

It’s thus important to treat your debt with the same prudent responsibility. You still want to be able to preserve your credit record as much as possible for your future.

This is a short term financial crisis and we need to think of our long term future and how our actions could affect it.

Reach out for help

According to iol banks are standing together to help financially distressed South africans.

We spoke to our personal banker this week who advised that banks are willing to help. But they are very cautious about who they will help. To qualify you will need to provide evidence that your income is directly affected as a result of the covid-19 pandemic.

Banks and credit providers have already tightened their risk profiles. They will now only consider clients for finance that are very low risk. This will count with extended payments as well. They will look at your previous credit payment history to see if you have had a recent change in your financial position.

What does this mean for over-indebted clients?

If you were battling to pay your accounts before the financial crisis then you will be high risk now for banks. They will most likely encourage you to seek debt restructuring advice to deal with your debt.

These options include:

Debt management (debt mediation)

We have a team of experts available that can help you with debt restructuring from the comfort of your home.

We work remote and always have so our operations are not affected by the lockdown. We have years’ experience in managing cases in a digital space so our team can serve you well during this time.

If you would like to find out more, you can visit our services section here: https://premierdebt.co.za/services/

We will have more information for you over the coming few weeks.

We will also be sharing updates and interesting articles on Social media. If you would like to connect you can follow us here:

https://www.facebook.com/premierdebtnetwork

https://www.linkedin.com/company/premier-debt/

Thank you for your time I hope my thoughts help you to keep a calm head and focus on saving during this period.

Sending you peace and positive vibes. Please be safe and enjoy the relaxing time at home. We will get through this together.

Best regards

Judy Hayes

Premier Debt

I want to apply for Debt Management.

Please only communicate via email with me.