How to use the snowball method to pay off your debt

The snowball method focuses on tackling your small debts first. It involves paying as much money to your smallest debts, regardless of the interest. This makes it possible for you to reward yourself for wins along your debt pay off journey.

This method is compared to a snowball running down a hill. A snowball starts with a small amount of snow in your hand. As it rolls down the hill, it gathers more snow and eventually becomes a giant snow boulder. It’s the same with your debt. Once the smallest debt has been paid off, you roll the money you were paying towards that debt into your payment towards your next smallest debt. And once that one is paid off, you roll that money onto the next one, and so on. This way, you continue to increase the amount you’re paying towards your smallest debts. You are knocking them off one by one. Your payments “snowball” into faster debt repayment. You will focus on paying off your smallest debt balances first, while paying the minimum payment on all other debts.

In this article we will provide you with insight on:

1. How to use the snowball method

2. Advantages of the snowball method

3. Disadvantages of the snowball method

4. What do experts say about the snowball method

5. Is this the right method for you?

6. What are my options if I can’t pay the minimum installments?

How to use the snowball method

Step 1

The first step is to be sure that you’ve budgeted enough to cover the minimum monthly payment for every debt. Once that is covered you will need to budget extra that you can start allocating towards your debt. A good way to do this would be to work out your budget of income and expenses and see what is left to allocate. If you are not sure of your budget, you can use our budget planning tool to help you work it out.

Step 2

Arrange all your accounts by balance you owe, from smallest to largest. Disregard the interest rate on each.

Step 3

Each month, pay the minimum amount on each account, except the smallest one. You will allocate the additional debt budget towards this account until its paid up.

Step 4

When you have paid off your first account, it’s time to tackle the next account. You will roll the extra money and the minimum installment of the paid-up account to your next account in line.

Of course, you must continue making the minimum payments on all other debts.

Step 5

Repeat the process until you are debt free. You will keep knocking off debts and then diverting all the freed-up money toward the next debt in line.

Here’s how it could look in real life.

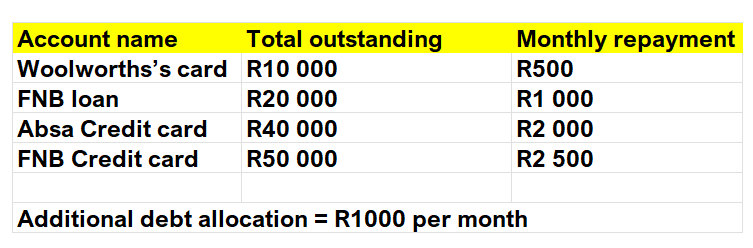

Imagine this is a snapshot of your accounts that you need to pay off. You can also afford to allocate R1000 extra towards your debt every month.

Every month you will pay R6000 to maintain the minimum installments. There will also be an additional R1000 available to pay towards getting out of debt.

You will start by paying R1500 to the Woolworths card (R500 minimum due + R1000 extra). Continue for a few months until the card is paid off. With Woolworths out the way, you can focus on the FNB loan. You will now pay R2500 (R1000 minimum installment + R1500 freed up from Woolworths’s account) monthly into your FNB loan until its paid up. Continue with all the accounts until the FNB credit card is settled in full. You will now be debt free.

Advantages of the snowball method

The primary advantage of the snowball method is the psychological boost. By seeing your debt decreasing, it can increase your motivation to get out of debt. Even if you’ve only paid off a small balance, your confidence in the progress you’re making grows.

It also helps reduce financial stress. The snowball method eliminates worry about how to tackle all your debt at once.

Disadvantages of the snowball method

The biggest disadvantage is the potential to pay more for your debt. By focusing on paying off the smallest debt first, you are ignoring the interest charged. This means you could end up paying off more interest over a longer period. You are in essence repaying your “costliest” debt first.

What do experts say about the snowball method?

In a field study where consumers used both the avalanche and snowball methods. It was discovered that the snowball method is more likely to lead to success. This is due to the psychological benefits and instant gratification related to paying off debt quicker. Every account that you pay off, gives you motivation to stay committed to your debt free goal. Motivation is the key for you to stay on your path and not take on more debt when another account is paid off.

Is this the right method for you

Choosing the right debt method ultimately depends on your personality. If you need motivation to stay committed, the snowball method will give you quick wins. This helps you to stay on track. If the downfall of paying more interest over time bugs you then this may not be the ideal program for you.

What are my options if I can’t pay the minimum installments?

If you are unable to pay the amount required by your creditors, it’s a sign that you need to seek help. As you can see for the snowball method to work, you need to be able to afford the minimum payments and extra.

Your best option will be work with a professional that can reduce monthly payments and outstanding interest. This will help you bring your debt and expenses back into balance with your income.

A professional debt adviser can manage your debt on your behalf.

You will pay one monthly payment for all your debts and your debt adviser pays your creditors for you.

You also benefit by leveraging the education and experience of your debt adviser for your own affairs. This can save you thousands in interest and also help you repay your debt in a shorter space of time.

For mor information you can read up about the debt restructuring program or complete the form below to chat to us and take a free assessment.

Conclusion

The snowball debt repayment method focuses on repaying small debts first. This leads to quick wins which keeps the person motivated to stay on track. The downside is the interest charge is more over a longer period. If your unsecured debts will take more than 5 years to pay, its best to consider options for debt relief.